Regulatory changes compliance and associated risks

Emergent regulatory changes can swiftly impact companies, prompting them to pause significant portions of their in-fly programs and initiatives. Understanding the essence of these regulatory adjustments and their criticality is paramount.

The crux of the matter lies in the:

- substantial penalties imposed on companies failing to promptly align with these amendments

- explicit legal and compliance obligations the amendments entail

It is imperative to delve into the intricacies of these regulatory shifts to grasp their significance and the urgency they demand.

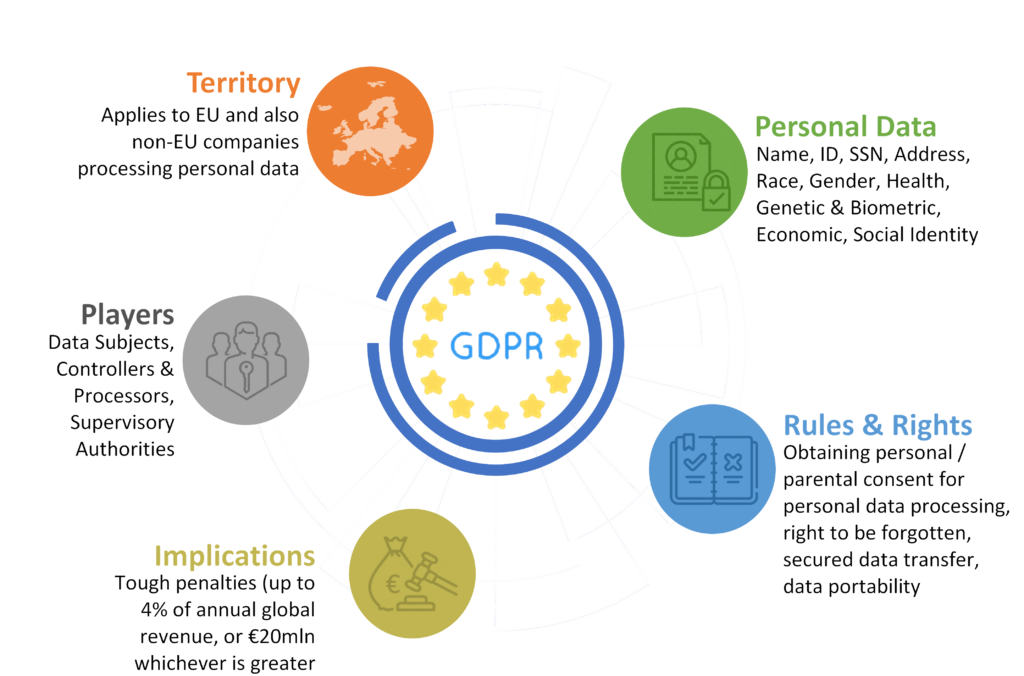

Let’s take the General Data Protection Regulation (GDPR) implementation as a prime illustration:

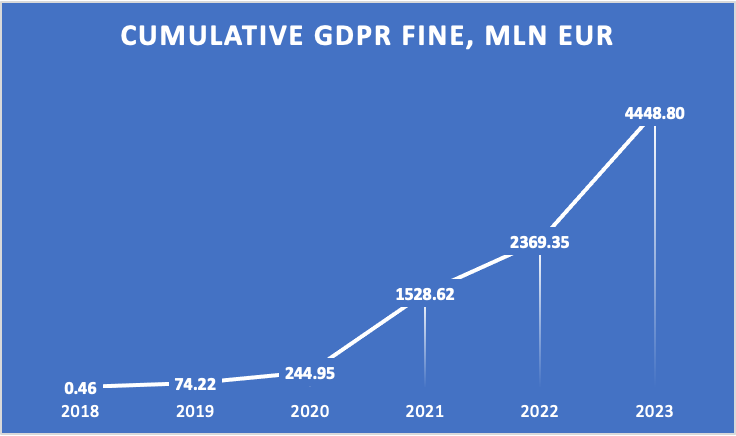

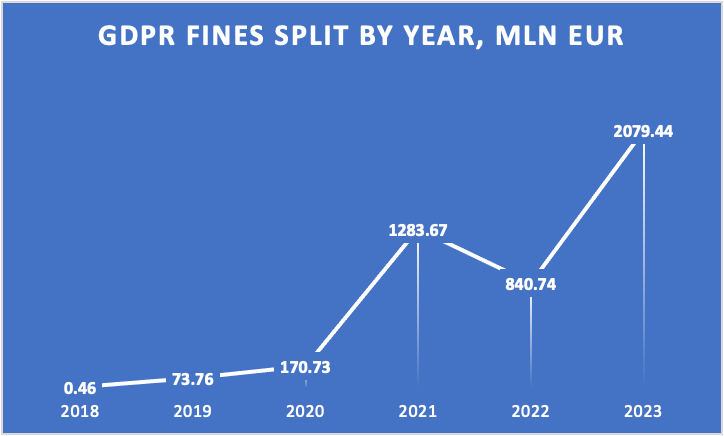

Following GDPR reinforcement in late May 2018, the total cumulative fines have surpassed 4.4 billion euros. Notably, several records were set in 2023, including:

- the collection of over 2 billion euros (almost equivalent to the sum of all penalties collected between 2018 and 2022, amounting to 2.3 billion euros)

- a single fine breaking the 1 billion threshold (such as Meta’s fine of 1.2 billion in May, surpassing the previous record held by Amazon at 746,000 euros)

Data sourced from https://www.enforcementtracker.com/

These statistics showcase the:

- importance of timely and correct implementation, meeting all standards and regulations

- continuous dedication to maintaining data protection standards

- growing financial penalties associated with non-adherence

For over two decades Allied Testing has been deeply engaged in QA and testing of various regulatory changes, including GDPR, for our esteemed clients across diverse industries world-wide. We possess extensive subject matter expertise in:

- ensuring ISO compliance

- adhering to industry-specific and global standards and regulations

- adapting to new regulation or modifications

The expertise acquired during 20+ years of operation, combined with our meticulous QA and testing approach, enables us to help our clients significantly mitigate both regulatory and technological risks.

Regulatory change list for 2024-2025 looks pretty impressive:

- ESG compliance

- EU AMLA adjustment including crypto asset providers

- investment services regulation

- PSD II adjustments and PSD III and also IBAN-name-check as part of PSR

- Digital euro

- the crypto asset regulation MiCAR

- and many more

Therefore, let’s minimize risks and take proactive steps to ensure proper implementation of any new regulatory changes together! Our Allied Testing team is here to guide you through the process and provide the support you need.

Download pdf fileback